Third-quarter 2024 revenue Sustained activity growth

- REVENUE UP 12% TO €1,434M

- REVPAR UP 5.3% VS. Q3 2023

- PIPELINE UP 6% VS. END OF JUNE 2024

- CONFIRMED REVPAR GROWTH GUIDANCE FOR 2024

- EBITDA NOW EXPECTED BETWEEN €1,100 MILLION AND €1,125 MILLION IN 2024

Once again this quarter, the Group posted solid sales growth, in line with its targets. This good performance was driven in particular by the dynamism of our Luxury & Lifestyle brands, sustained growth in high-potential regions and the positive impact in France of the Olympic Games, for which Accor was one of the Premium partners. By continuing to combine operational agility, quality of execution and financial discipline, we are convinced of our ability to consolidate the solidity of our business model over the long term and deliver significant growth in our results in 2024. Sébastien Bazin, Chairman and CEO of Accor

While RevPAR growth is normalizing, the Group continues to benefit from its diversification in terms of geography and segment. The Group’s two divisions, Premium, Midscale and Economy (PM&E) and Luxury & Lifestyle (L&L), both posted solid performances.

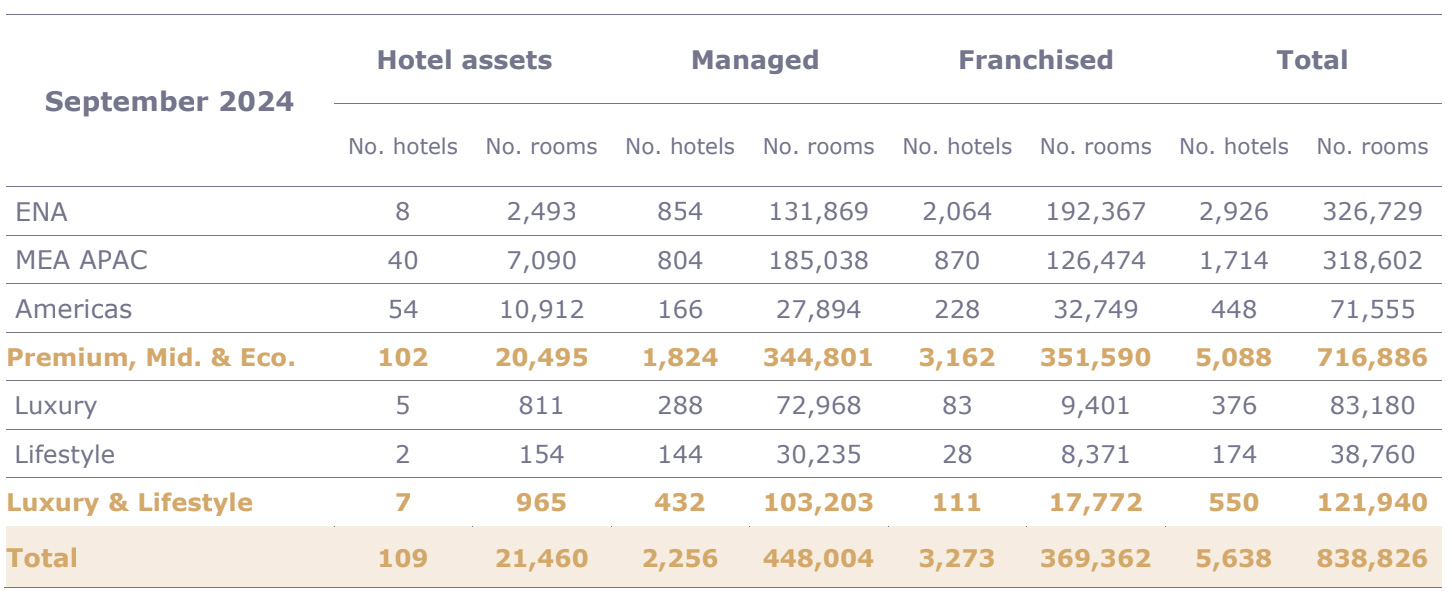

During the third quarter of 2024, Accor opened 47 hotels, representing 8,000 rooms, i.e. net unit growth of 3.2% over the last 12 months. At the end of September 2024, the Group had a hotel portfolio of 838,826 rooms (5,638 hotels) and a pipeline of 231,000 rooms (1,380 hotels).

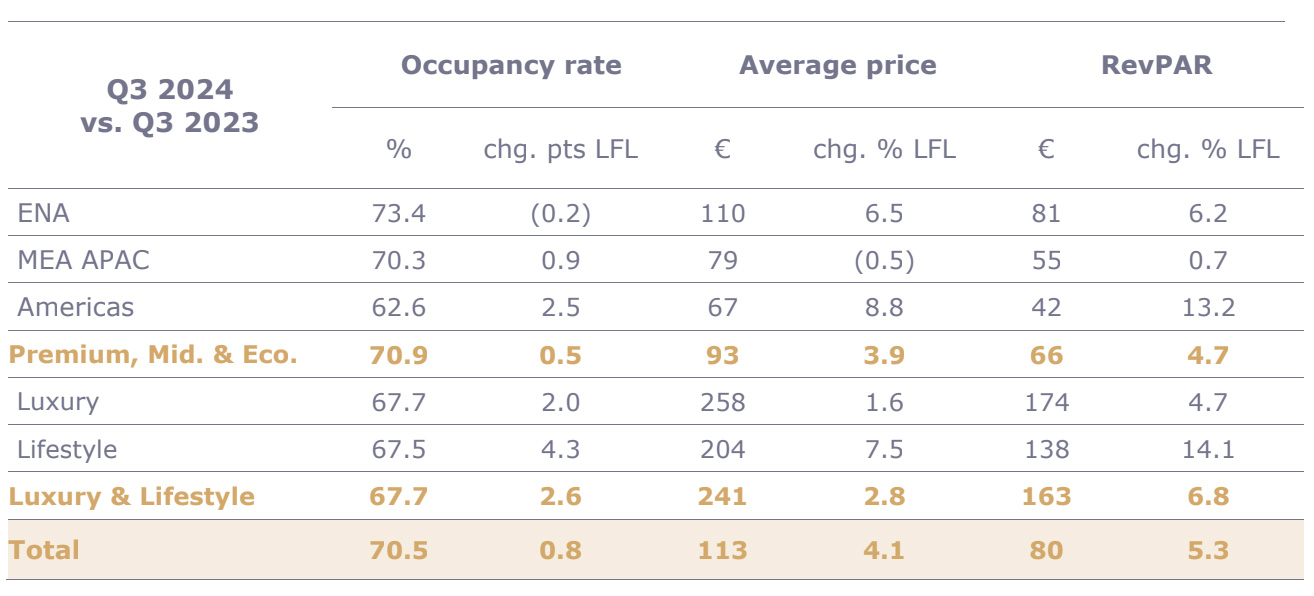

Third quarter 2024 RevPAR

The Premium, Midscale and Economy (PM&E) division posted a 5% increase in RevPAR compared to the third quarter of 2023, still mostly driven by prices rather than by occupancy rates.

- The Europe North Africa (ENA) region posted a 6% increase in RevPAR compared to the third quarter of 2023.

- France, representing 45% of room revenue for hotels in the region, benefited from the Paris Olympic Games. As anticipated, the event reported strong RevPAR growth in Paris. In the provinces, business was resilient during the summer, but September was affected by a high comparison basis linked to the Rugby World Cup held in September and October 2023.

- The United Kingdom, representing 12% of the region’s hotel room revenue, posted slightly positive RevPAR growth in line with previous quarters, with similar performances between London and the provinces.

- In Germany, representing 12% of room revenue for hotels in the region, RevPAR growth was stronger than in the two countries mentioned above throughout the summer.

- The Middle East, Africa & Asia-Pacific region posted a 1% increase in RevPAR compared to the third quarter of 2023, with contrasted performances by country.

- The Southeast Asia, representing 34% of room revenue for hotels in the region, was the zone with the strongest RevPAR growth, driven by international demand, including from China.

- The Middle East, Africa, representing 20% of room revenue for hotels in the region, was negatively impacted by the timing of religious pilgrimages, including the Hajj, and the delayed start of the Umrah in Saudi Arabia. Added to this is the gradual reopening of 5 hotels in Dubai which were closed following the floods in April. Nevertheless, we saw a sequential improvement of the activity month after month.

- In the Pacific, representing 26% of the region’s room revenue, RevPAR growth was flat, penalized by weak economic growth and low consumer confidence.

- In China, representing 21% of the region’s room revenue, RevPAR change was negative. As in many industries, the market remains challenging. Although Chinese customers are traveling abroad, benefiting Southeast Asia in particular, the domestic market remains penalized by the decline in consumption.

- The Americas region, which mainly reflects the performance of Brazil (60% of the region’s room revenue), recorded an increase in RevPAR due to strong demand, particularly from business customers and events in Sao Paulo.

The Luxury & Lifestyle (L&L) division posted a 7% increase in RevPAR compared to the third quarter of 2023, mainly driven by higher occupancy rate.

- The Luxury segment, representing 73% of the division’s room revenue, reported a 5% increase in RevPAR compared with the third quarter of 2023. This performance was driven by all brands and reflects the various trends observed in PM&E’s markets, but with a slight premium.

- The Lifestyle division reported RevPAR growth of 14% compared with the third quarter of 2023, once again driven by resort hotels, notably in Turkey and Egypt.

Group revenue

For the third quarter of 2024, the Group recorded revenue of €1,434 million, up 12% compared to the third quarter of 2023. This growth breaks down as a 7% increase for the Premium, Midscale and Economy division and an 18% increase for the Luxury & Lifestyle division.

Scope effects, mainly related to the acquisition of Potel & Chabot (in October 2023) in the Luxury & Lifestyle division (Hotel Assets & Other segment), contributed by €56 million.

Currency effects had a negative impact of €30 million, mainly related to the Brazilian real (-13%), the Egyptian pound (-37%).

Premium, Midscale and Economy revenue

Premium, Midscale and Economy, which includes fees from Management & Franchise (M&F), Services to Owners and Hotel Assets & Other of the Group’s Premium, Midscale and Economy brands, generated revenue of €821 million, up 7% compared to the third quarter of 2023. This increase is broadly in line with the level of activity in the third quarter.

The Management & Franchise (M&F) business posted revenue of €238 million, up 6% compared to the third quarter of 2023 and slightly exceeding RevPAR growth during the period (+5%).

Services to Owners revenue, which includes Sales, Marketing, Distribution and Loyalty activities, as well as shared services and the reimbursement of hotel costs, amounted to €319 million, up 14% compared to the third quarter of 2023 boosted by the services provided to the Olympic Games organizing committee.

Hotel Assets & Other revenue amounted to €265 million, up 1% compared to the third quarter of 2023. This segment, which is closely tied to activity in Australia, is affected by the current weakness of leisure demand.

Luxury & Lifestyle revenue

Luxury & Lifestyle, which includes fees from Management & Franchise (M&F), Services to Owners and Hotel Assets and Other of the Group’s Luxury & Lifestyle brands, generated revenue of €635 million, up 18% compared to the third quarter of 2023. This increase reflects the excellent performance of this business and a scope effect linked to the acquisition of Potel & Chabot.

The Management & Franchise (M&F) business posted revenue of €119 million, up 10% compared to the third quarter of 2023, driven by RevPAR growth (+7%) and the Lifestyle portfolio growth.

Services to Owners revenue, which includes Sales, Marketing, Distribution and Loyalty activities, as well as shared services and the reimbursement of hotel costs, amounted to €366 million, up 7% compared to the third quarter of 2023 in line with the RevPAR.

Hotel Assets & Other revenue amounted to €150 million, up 70% compared to the third quarter of 2023. This activity includes a significant scope effect linked to the acquisition of Potel & Chabot in October 2023 and the acquisition of Rikas in March 2024.

Management & Franchise revenue

The Management & Franchise (M&F) business recorded revenue of €358 million, up 7% compared to the third quarter of 2023. This change reflects RevPAR growth in the various geographical areas. The main distortions to note are:

- In the PM&E division for the ENA region, revenue growth benefited from the receipt of some termination fees;

- In the PM&E division for the Americas region, revenue growth was negatively impacted by the exchange rate effect linked to the Brazilian real;

- In the Lifestyle segment, revenue growth was boosted by strong network growth in recent months.

Outlook for FY 2024

For FY 2024, Accor confirms the following guidance:

- RevPAR growth between 4% and 5%

- Net unit growth (NUG) between 3% and 4%

- Positive contribution to EBITDA from Services to Owners

And upgrades the following guidance:

- Group EBITDA now expected between €1,100 million and €1,125 million (previously “between €1,095 million and €1,125 million”)

Events from July 1st, 2024 to October 24th, 2024

AccorInvest

Since 2023, AccorInvest, which is accounted for under the equity method in the Group’s consolidated statements, has initiated a significant asset disposal plan to be completed by 2025, aimed at optimizing its financial structure by reducing its debt and improving the profitability of its asset portfolio.

In July 2024, AccorInvest finalized the refinancing of its bank borrowings, extending by two years the maturities due in 2025, along with a partial reimbursement. To facilitate the execution of this refinancing, a capital increase in the form of preferred shares was subscribed to by the company’s shareholders, including Accor for €67 million.

Furthermore, the shareholders are committed to subscribe, by March 2025, to an additional issuance of preferred shares for maximum amount equivalent to the first issuance, and a function of the amount of asset disposal plan completed by AccorInvest. Following the success of its bond issue in September 2024 and progress on its asset disposal programme, the maximum amount is now limited to €34 million.

Hybrid bond refinancing

In August 2024, Accor successfully completed the October 2019 hybrid bond refinancing transaction:

- On August 28, Accor issued perpetual hybrid bonds for an amount of €500 million with a 4.875% coupon. The transaction was oversubscribed five times reflecting renewed investors’ confidence in the credit quality and the growth potential of the Group;

On September 5, Accor successfully completed the refinancing of its October 2019 hybrid bond following the completion of the Tender Offer on a perpetual hybrid bond (4.875% coupon) for a total amount of €352.3 million. Following the completion and settlement of the Tender Offer which took place on September 9, more than 70.46% of the initial aggregate principal amount of the Existing Bonds have been purchased by Accor.

RevPAR before sales tax by segment – Q3 2024

RevPAR before sales tax by segment – YTD 2024

Hotel portfolio – September 2024

About Accor, a world-leading hospitality group

Accor is a world leading hospitality group offering experiences across more than 110 countries in 5,700 properties, 10,000 food & beverage venues, wellness facilities or flexible workspaces. The Group has one of the industry’s most diverse hospitality ecosystems, encompassing more than 45 hotel brands from luxury to economy, as well as Lifestyle with Ennismore. Accor is committed to taking positive action in terms of business ethics & integrity, responsible tourism, sustainable development, community outreach, and diversity & inclusion. Founded in 1967, Accor SA is headquartered in France and publicly listed on the Euronext Paris Stock Exchange (ISIN code: FR0000120404) and on the OTC Market (Ticker: ACCYY) in the United States. For more information visit group.accor.com or follow us on X, Facebook, LinkedIn, Instagram and TikTok.

Line Crieloue

Group external communications – Executive Director – Corporate

+33 1 45 38 18 11

Accor

Recent Posts

- Mahasiswa Unej Diduga Bunuh Diri, Jatuh dari Lantai 8 Gedung Kampus

- Tui appoints Bart Quinton Smith as UK sales and marketing director

- The Ritz-Carlton, Bangkok Debuts in Thailand

- Air pollution now linked to hospital admissions for mental health, study finds | Science, Climate & Tech News

- Peta Fraksi dan Kilas Balik Pengesahan UU HPP Pangkal PPN 12 Persen

Recent Comments