Swiss tourism amid dueling crises: A look behind the numbers

During the Covid crisis, many hospitality players suffered, some weathered the storm and a few even thrived. As the pandemic finally recedes and another threat surges to the forefront, we take a look back at how hospitality has been reshaped by recent events in Switzerland. Two specialists from the EHL Hospitality Business School delve into the statistics before and during Covid, and draw some surprising conclusions. Dr. Stefano Borzillo, Associate Professor of Organizational Behavior, specializes in topics relating to individual and collective performance and for a more financial perspective, Dr. Augusto Hasman, also an associate professor at EHL, who teaches finance and risk management.

Q. Which Swiss cantons’ tourism suffered the most and the least?

With business travel falling off a cliff, total visitors to Zurich plummeted 68%, while Appenzell Inner-Rhodes—a rural canton in central Switzerland—suffered a loss of only 4.9% and so was the winner in terms of number of visitors. In terms of Swiss visitors, the loser was again Zurich with a loss of 55% of their Swiss tourists in 2020. On the other hand, there were four cantons that actually increased the number of Swiss visitors in 2020 with respect to 2019, including Appenzell Inner-Rhodes (+5.28%), the Grisons (+2.96%), Neuchâtel (+7.87%) and Uri (+12.84%). All the others suffered a fall in the number of Swiss visitors.

The winners are less urban, sparsely populated and have nice sightseeing. Travelers generally steered clear of cities during the pandemic. This also explains why the losers are more geared toward an international business clientele. In 2019, 11 cantons received more than 20% of their foreign visitors from the U.S., China or India while in six cases it was more than 30% (Lucerne with 47%, Obwald with 63%, Zug 34%, Schwyz 39%, Nidwald 39%, Berne 36%). These figures explain why these six cantons suffered in 2020 a fall in their foreign visitors of close to 80%. Nevertheless, the negative impact in the total number of nights for those cantons was close to 50% (except in Bern with 39% and in Schwyz with only 29%). This can be partially explained by the fact that the tourists that did indeed visit Switzerland ended up staying for longer periods of time (in the particular case of Bern, the total number of nights spent by Swiss visitors even increased although the number of Swiss visitors decreased).

Q. During Covid lockdown, the Swiss tourism board encouraged regional travel. Did this actually happen?

It is indeed a mirage effect, a false idea that many citizens have had, to think that the Swiss traveled more within the 26 cantons during Covid. Apart from the four winning cantons mentioned above, all the other cantons hosted fewer Swiss tourists during this period. The Swiss may have gone on more ‘day trips’ within Switzerland during Covid, but this doesn’t show up in the data.

It is especially important to note that many hotels in Switzerland (regardless of canton) decided to remain open during this period to cover their fixed costs. In other words, they lost – by remaining open – less money despite the low occupancy rate. But it’s not just about staying open. In an attempt to rebalance tourism, many hotels have had to offer attractive prices and be creative to make their offer more interesting. For example, some hotels (whether in rural or urban areas) have offered an “alternative use” for some of their rooms by adding, for instance, furniture, a fridge, desk or microwave to their larger rooms and selling them as “apartment-hotels”. This allowed the rooms to be occupied for longer periods, thus preventing them from remaining empty.

Q. Did Swiss hospitality suffer as much as expected during Covid?

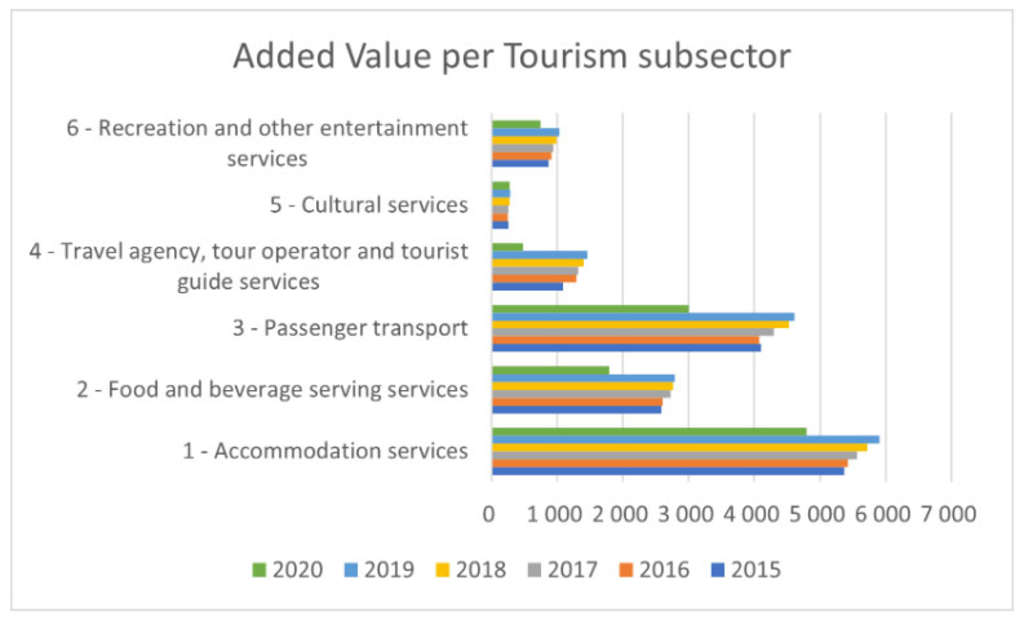

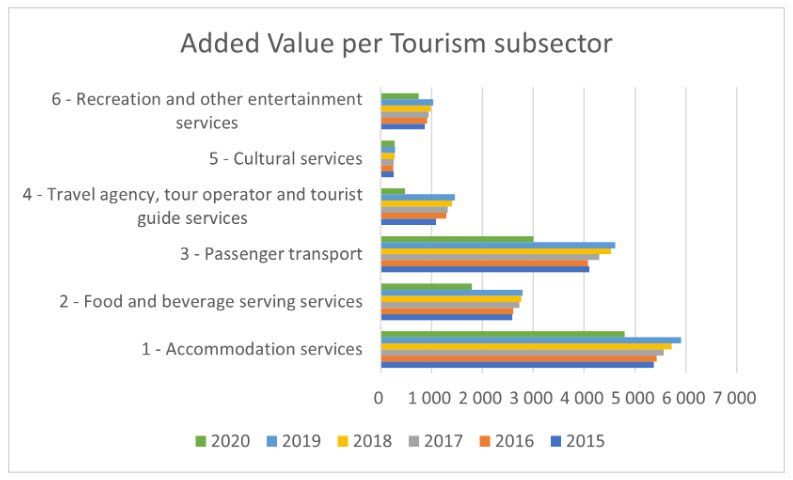

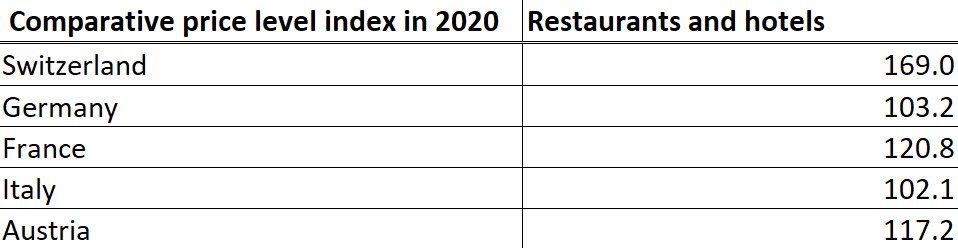

To analyze the impact on the sector, it’s best to look at the gross value added of the sector. We can see that it fell to 2006 levels. Value added is the economic contribution of an industry.

Table 1:

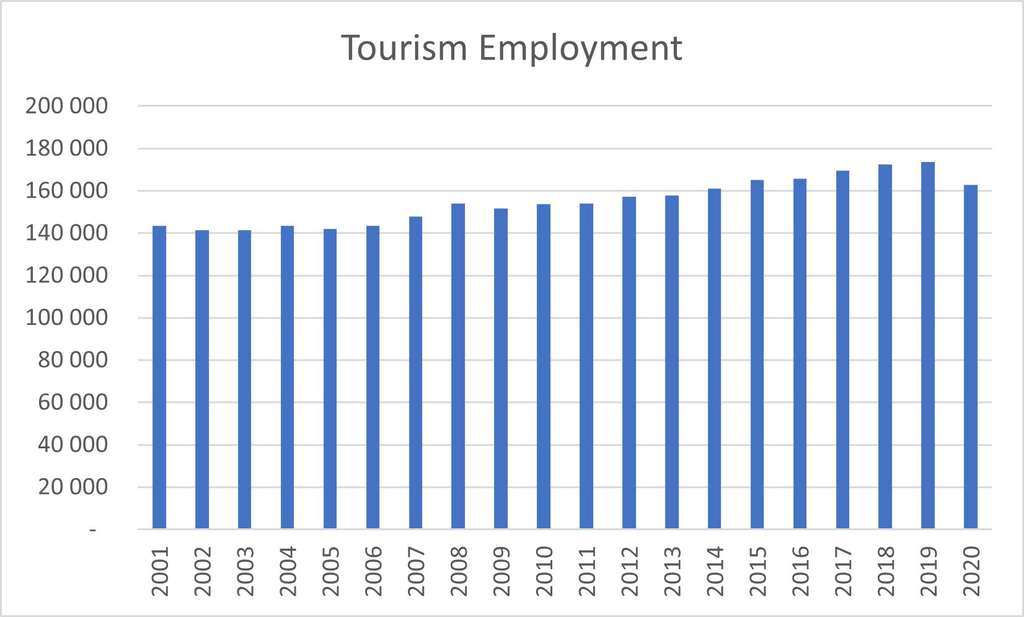

In terms of employment, hospitality’s contribution dropped to 2014 levels. In 2020, hospitality employed fewer people in Switzerland than it did almost a decade ago.

Table 2:

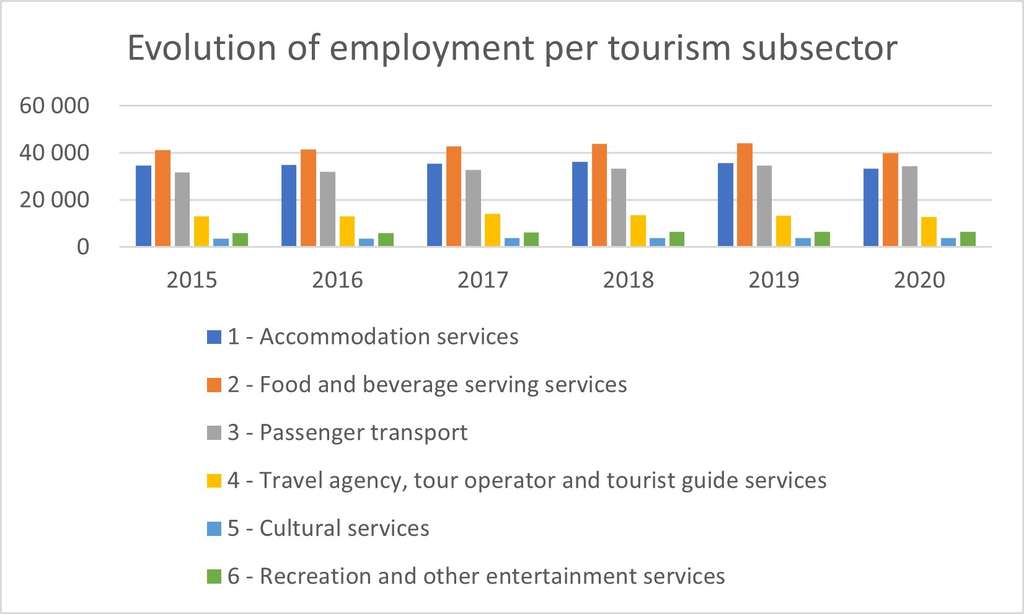

Finally, if we dig deeper into the reasons behind such an impact, we see that the food and beverage subsector shed the most employees, while in terms of added value the worst off were travel agencies, tour operators and tour guide services.

Table 3:

We can see that 2020 was the worst year, in terms of performance, of the last five years for all the subsectors.

Table 4:

We can see that in the case of employment, the figures are the lowest they’ve been in the last five years for all the subcategories (except for passenger transport, cultural services and recreation, which have managed to keep levels on par with those in 2019).

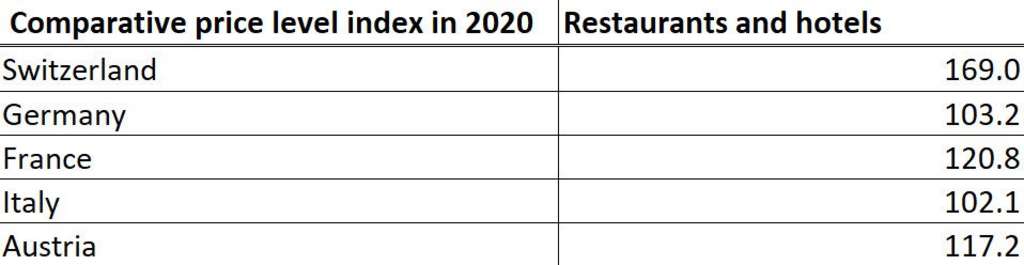

Nevertheless, the most plausible explanation – in addition to Covid – of such a drop was the fact that Swiss hotels are so much more expensive than in neighboring countries, as seen below.

Table 5:

Q. Will those jobs come back?

It is difficult to anticipate when the sector will fully recover and some signals show that it will be slower than for other sectors of the economy (some economists predict that it will be difficult to fully recover before 2026). Another open question is how to bring back not only tourists but employees who found jobs in other sectors during the crisis.

Q. High turnover, undesirable hours, disgruntled customers: How has Covid reshaped hospitality employment?

The complete lockdown and the temporary layoff of hospitality workers allowed the latter to experience – for a few months – a much less arduous pace of life and to spend more quality time with family. Once the lockdown was over, some of these workers made the decision either to apply to hotels that offered more pleasant working conditions or work in other, less arduous hospitality subsectors such as co-working centers, private clinics, or homes for the elderly. This is why many hotels in Switzerland are struggling mightily to recruit workers such as food & beverage professionals, chefs, waiters and receptionists. It is also becoming difficult for hotels in Switzerland to recruit seasonal workers. Interestingly, some hospitality workers have completely reshuffled their work schedule, working part-time in a hotel and the rest of the time in other companies (not necessarily in the hospitality sector), or even starting their own business.

Q. Are hospitality & tourism a substantial part of the Swiss economy? What has been the impact of Covid?

Table 6:

Tourism’s contribution to the Swiss economy in 2020 was the weakest in the last twenty years. Employment has fallen to 2006 levels. In short, tourism has lost a decade or two.

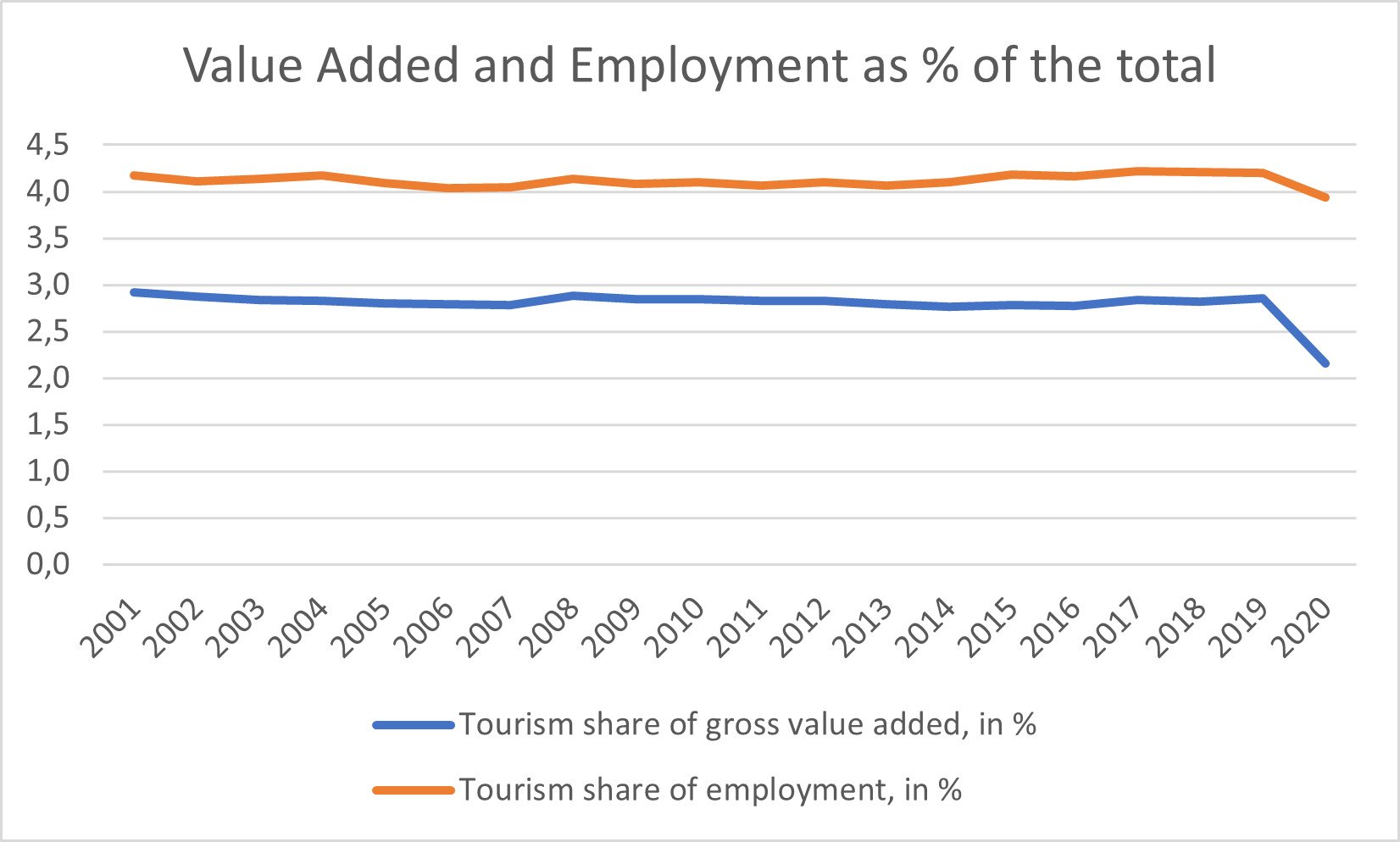

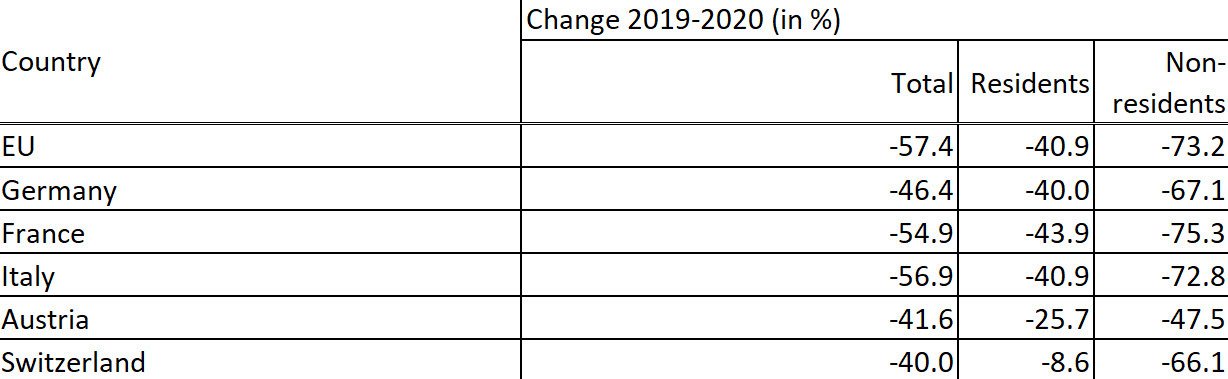

Compared to its EU neighbors, the Swiss continued to travel during the pandemic. Night stays were down a mere 8.6% among Swiss citizens versus the EU average of about 41%. Hotel reservations in the EU were down a startingly 73% in 2020 versus 2019, as seen in the table below. That’s almost 3 out of every 4 reservations cancelled!

Table 7: Changes in overnight stays in hotels and similar establishments by country, 2019–2020

Q. Will Russian sanctions affect Swiss tourism?

It is still early to speculate about the medium-term consequences for Swiss tourism of the sanctions that have been levied against Russia. Furthermore, Russians account for a very small portion (1.3% in 2019) of foreign tourism in Switzerland. Nevertheless, if we focus on the city level, they represented 4% of tourists and 6% in terms of night stays among foreigners in Zug (with similar figures for Bad Zurzach and Leukerbad in 2019), while 10% of foreigners taking to the baths at Bad Ragaz were Russian (17% in terms of night stays) before the pandemic.

Additionally, Russian tourists represent a “niche” market, since they are usually wealthy people (often business owners) who stay in 4- or 5-star hotels, located in urban centers and the most upscale ski resorts in Switzerland. These are generally people whose business activities are carried out partly (or totally) with European countries. During their leisure vacation (or business travel) in Switzerland, these tourists with high purchasing power generally have so-called “luxury” consumption habits. Russian travelers consume expensive goods and services and generate substantial revenues for the luxury establishments that host them.

Now that business exchanges between Russia and European countries have dried up, we can assume that Russian business owners will see a drastic drop in their cash flow and business revenues, which will, in turn, affect their purchasing power. Plus, the ruble has lost a lot of its value. Do these Russian business owners hold bank accounts in Switzerland? Can they withdraw their money? If they can, financing holidays in Switzerland may not be their top priority. Finally, flights between Russia and many countries have been suspended. For all these reasons, it is easy to assume that Switzerland will lose many of its Russian tourists and that some touristic destinations might be really hurt by the ongoing crisis.

Sources: All data were extracted from Switzerland’s Federal Statistical Office.

Ecole hôtelière de Lausanne

Communications Department

+41 21 785 1354

EHL

View source

Recent Posts

- Danny Pomanto Sebut Banjir di Makassar Kali Ini Cukup Parah

- Scenic Group reveals new year cruise offers

- Kemenekraf Proyeksikan Tiga Tren Ekonomi Kreatif pada 2025

- HOTLIST 2024 Successfully Concludes Its Official Event Series

- Albania to ban TikTok for a year as PM Edi Rama claims app inciting violence and bullying | World News

Recent Comments