Lemonade leans on Aviva to bring its next-gen insurance platform to the UK • TechCrunch

New York-based insurance giant Lemonade is officially launching in the U.K., its fourth market in Europe and fifth overall, with a little help from one of the oldest and largest insurance providers in the U.K.

Lemonade, for the uninitiated, emerged into the trillion-dollar insurance space back in 2015, with a new take on how consumers should be able to buy insurance. Mobile-first, and AI-powered automation for registering and filing claims was the name of the game, versus dusty old brokers and bureaucracy.

On top of that, the company has always been vocal about its ethics, positioning itself as the antithesis of a traditional insurance company — the company is a certified B Corp, meaning that it’s independently assessed for its social and environmental performance. Its business plan essentially involves charging a set fee, and then donating some of its underwriting profits to a charity as selected by each customer when they sign up.

Lemonade UK launch

But Lemonade is still very much a for-profit insurance juggernaut, having secured nearly $500 million in funding as a startup, from big-name backers including SoftBank, Alphabet’s GV, Sequoia Capital, and Allianz. The company hit the public markets in the midst of the pandemic two years ago, and as with many digital-first cloud companies during the lockdown years its shares soared, with the company hitting a market cap of more than $10 billion at one point — more than triple its early public valuation — before falling back down to Earth with a crash. The company’s valuation today is less than $1.5 billion, reflecting a broader insurtech downturn that has hit a lot of companies hard.

More recently Lemonade closed its first acquisition when it bought auto insurance startup Metromile, before promptly laying off around 20% of its staff. A sign of the times, perhaps.

Lemonade lands in the U.K.

And all this hullaballoo takes us to today, where Lemonade is now officially open for business in the U.K., where it’s going to market with a slightly more trimmed down offering compared to what it offers in the U.S. Indeed, in its domestic market, Lemonade offers insurance spanning contents (renters), homeowners, pet, car, and life, while in Germany, the Netherlands, and France where it’s expanded into over the past few years, it’s limited to contents insurance.

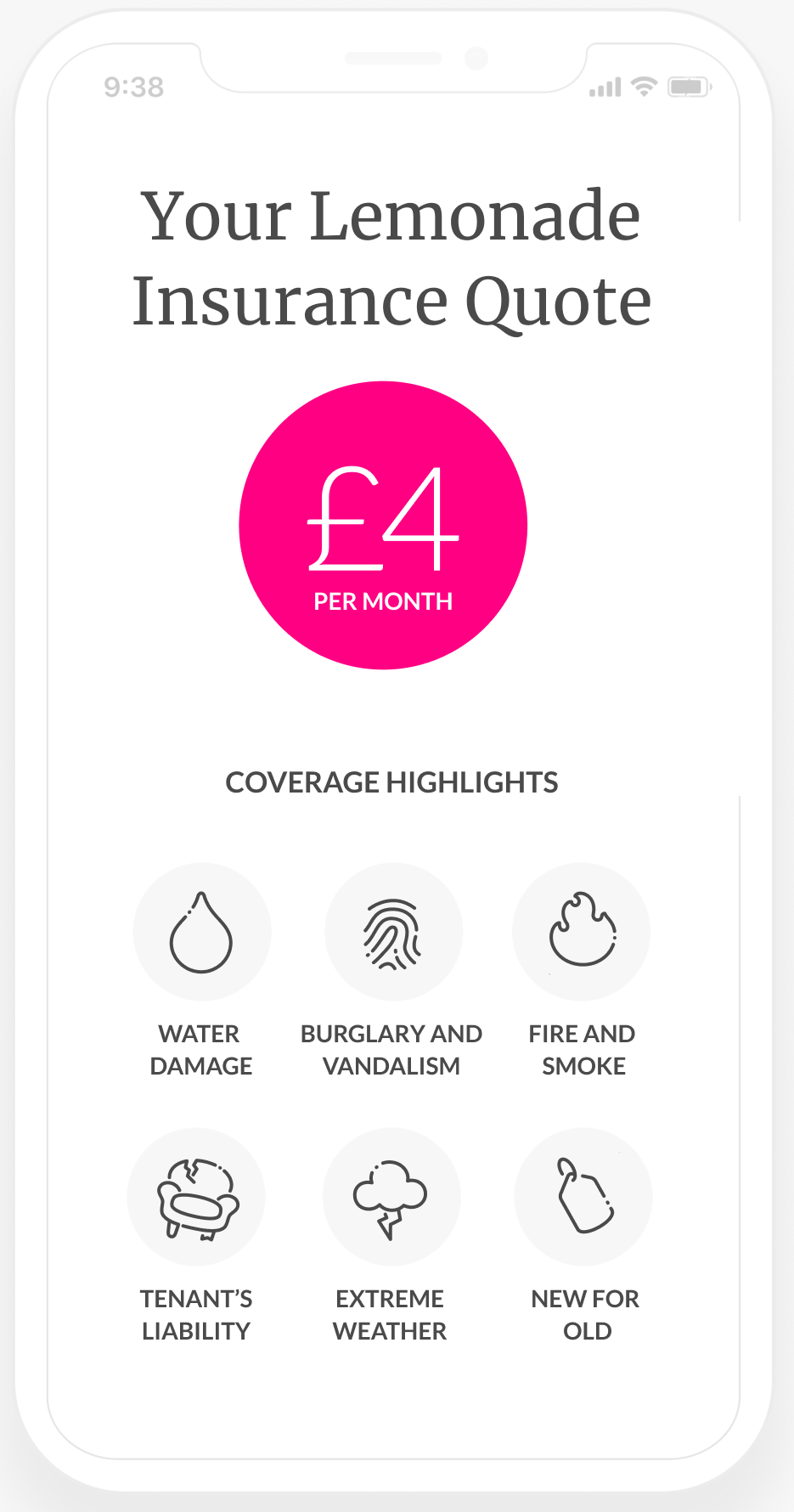

For the U.K. market, Lemonade is offering contents insurance starting at £4 per month, and includes global coverage for personal items of up to £2,000 in value each up to a total value of £100,000. Customers can pay extra fees for additional coverage, such as accidental damage to mobile devices.

Although Lemonade is a fully-licensed insurance carrier in its own right, the company has formed a strategic partnership with Aviva, one of the largest general insurers in the U.K. At first, this might seem like an odd coupling given that they are essentially competitors, but it does actually make sense. Lemonade is the young tech-driven upstart looking for help scaling in a lucrative new market, while Aviva is the $11 billion incumbent with roots running back more than 300 years, seeking to tap a younger demographic. And the first fruits of this partnership will see Aviva serve as Lemonade’s reinsurance partner.

“We share a common outlook for how digital, AI and data can transform customer experiences, and the role insurers can play in building stronger communities,” said Adam Winslow, CEO of Aviva UK and Ireland general insurance, in a statement. “In our 325 year history we have adapted and thrived in a changing world, and our partnership with Lemonade is a marker of our intent to continue just this.”

Recent Posts

- 18 Polisi Peras WN Malaysia di DWP Bakal Disidang Etik Pekan Depan

- American Airlines ‘briefly’ grounds all flights in US

- Hilton & Voyager Space Share Details on the Future of Food, Comfort in Space Travel at the 75th International Aeronautical Congress Panel

- Stranded NASA astronauts send Christmas message from space | Science, Climate & Tech News

- Sekjen PDIP Hasto Tersangka KPK Dijerat Pasal Beri Hadiah ke KPU

Recent Comments