H1 2024 European Hotel Transactions

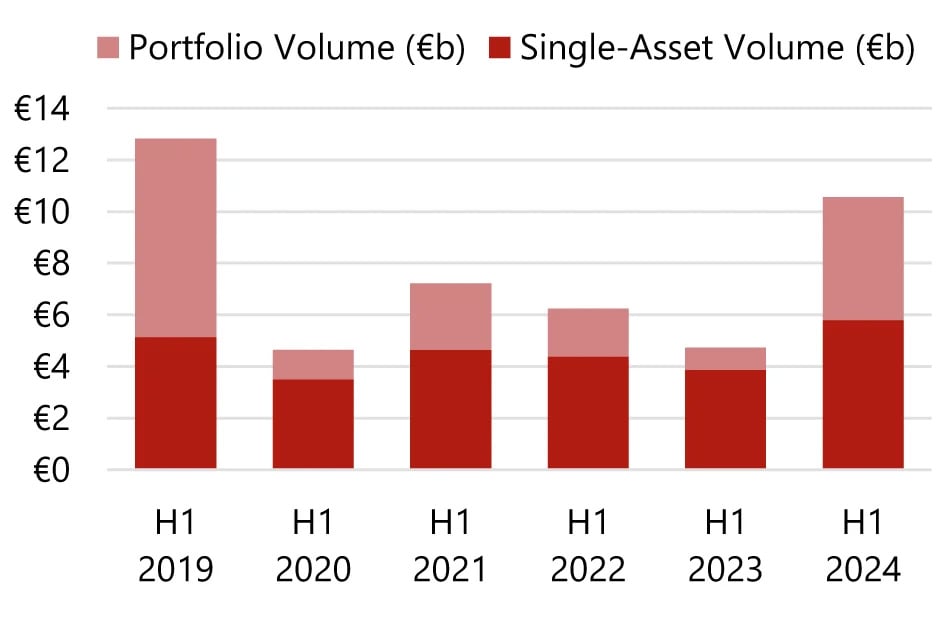

Coming out of a high-inflation, high-interest-rate environment, which negatively impacted hotel transactions in Europe in 2023, transaction activity increased to the highest levels since 2019 in the first half of 2024. Reaching €10.6 billion, the total volume transacted increased by 123% year-on-year, already reaching the total volume for the whole of 2023. There were 20% more transactions this semester, with a decrease of 11% in the number of rooms per hotel, translating into a 30% increase in price per room over H1 2023.

General Commentary

- Transaction volumes were quite evenly spread over the semester, with January recording the highest level of activity, followed by April and May.

- The single-asset to portfolio transactions volume ratio returned to 1:1, similar to the long-term average pre-pandemic.

Chart 1: H1 2024 Transaction Volumes Twice Those of 2023

- Single-asset transaction volumes increased 50% year-on-year last semester, totalling €5.8 billion, surpassing H1 2019 totals for the first time since the start of the pandemic. Notable transactions included the 138-room Park Hyatt Zürich, acquired by Oaktree Capital Management, Trinity Investments and UBS AM REPM MM from Hyatt International, and the proposed Six Senses London, acquired by Gruppo Statuto from C C Land Holdings for £180 million (€211 million).

- Portfolio transaction activity doubled year-on-year, despite eight fewer transactions compared to H1 2019. While the volume reached €4.7 billion, the highest since 2019, it remains nearly 40% behind pre-pandemic levels. Notable transactions included the acquisition of ten Radisson Blu Edwardian hotels in the UK by Starwood Capital from Edwardian Hotels London for an amount close to £800 million (€450,000 per room), along with Blackstone’s acquisition of 33 Village Hotels across the UK from KSL for approximately £800 million (€215,000 per room).

Chart 2: Strong and Steady Transaction Volumes Throughout 2024

- The largest net buyers over the first semester were private equity firms (€1.1 billion) and hotel investment companies (€894 million). The largest net sellers were owner-operators (€785 million) and real estate investment trusts (€735 million).

- Nearly two-thirds of total transaction volume occurred in the UK (38%), Spain (14%) and France (12%). London was the most active city (€2.0 billion) before Paris (€1.0 billion) and Zürich (€276 million).

Chart 3: The UK Dominates the European Transactions Landscape in H1 2024

The Rise of Luxury Assets Transacted

With the pick-up in transaction activity last semester, the price per room increased by 30% year-on-year, 9% ahead of 2019 levels in nominal terms. Transactions where the price per room was above €1 million accounted for 12.2%, a volume which increased nearly two-fold, signalling a growing proportion of luxury assets transacted.

Chart 4: Luxury Assets Take Centre Stage in 2024

Investment Drivers for Luxury

Whilst average rate growth was a global phenomenon post-pandemic, luxury hotels have disproportionately benefitted from it, as ‘revenge leisure’ travellers splurged. High suite ratios and an array of bespoke ancillary services allowed luxury hotels to increase average rates by two-thirds in urban properties, and by even more in resorts.

Slightly sluggish volumes haven’t prevented very healthy top lines, which have driven profitability across most hotels, despite payroll and cost of goods increases (and often decreased profitability of F&B). RevPAR levels increased by 50% for urban properties, and by around 70% for resorts.

Chart 5: Luxury Properties Have Enjoyed Remarkable Rate Growth Since 2019

Improved net operating income (NOI) conversion thanks to the strong flow-through of higher rates has resulted in improved NOI margins of around 18% on average for urban properties and 16% for resort hotels.

As a result of these improved profit levels, the investment rationale for the acquisition, construction or conversion of assets in the luxury category has become stronger over the last few years. These assets are often trophy properties with intrinsic locational or character features which are difficult to replicate and thus make them unique. Luxury assets represented only around 5% of the total hotel supply in Europe in 2023, a relatively low share.

Chart 6: With Higher RevPAR Came Stronger Margins

Outlook

As average rate growth in the luxury space mostly started to taper off from late 2023, a trend that has continued across most European markets, a stabilisation of average rates is expected going forward, whilst pre-pandemic occupancy levels might take somewhat longer to return.

More stable operating costs as inflation stabilises, steadier construction costs, and the slowly decreasing cost of debt are positive trends for the hotel industry in general and are likely to support investment appetite for hotels going forward. Stronger cash flows support the thesis for both hotel conversions into more luxury positionings and investment in these types of properties.

Europe captured around 55% of the total share of visitors globally in 2023, according to the World Trade Organisation. Its strong fundamentals, strategic location, ease of access and sophisticated infrastructure should allow the continent to maintain this level of interest in the future, and the year-on-year global wealth growth (4.2% in 2023 alone) bodes well for luxury assets.

View source

Recent Posts

- Agent Diary: We’re only a week into peaks, if it hasn’t happened for you yet, it will!

- 4 Polisi Polres Jakpus dan Polsek Kemayoran Didemosi 5-8 Tahun Imbas Kasus DWP

- Opening of Ramada Plaza by Wyndham hotel in Jammu, J&K

- Crystal unveils collection of sailings for 35th anniversary

- How to Keep Guests and Hotel Teams Happy

Recent Comments